Hedge Fund of Funds Model

- Home

- Hedge Fund of Funds Model

The objective of the ETFMS Hedge Fund of Funds Model is to build a diversified portfolio of liquid alternative fund (primarily mutual funds) that provide a lower cost and a more liquid way to access exposure to risk-managed (hedge fund) strategies. Hedge Funds of Funds have generally been illiquid and have been available to institutions and accredited investors at a 3% management fee and 30% incentive fee cost structure.

Due to the proliferation of the liquid alternative strategies offered in 1940 Act funds (mutual funds registered under the Investment Company Act of 1940), it is now possible to build a broadly diversified portfolio of hedge funds that are not only liquid, but available at a much lower cost structure than the “3 & 30” cost structure. The Hedge Fund of Funds Model seeks to produce returns that have a higher correlation to broad hedge fund benchmarks such as the HFRX Hedge Fund Index at a substantially lower cost than what an investor would have to pay under a traditional hedge fund partnership structure.

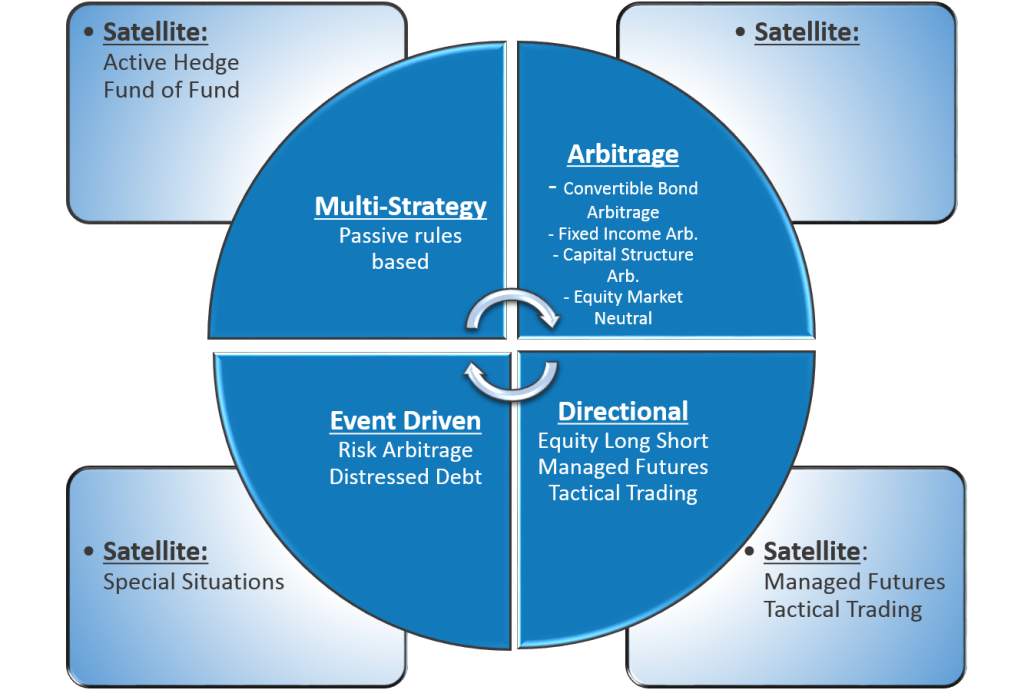

The model seeks to invest across four main segments of the hedge funds universe: 1) Multi-strategy funds 2) Arbitrage funds 3) Event-Driven funds and 4) Directional funds. Examples of strategies include Fixed Income Arbitrage, Convertible Bond Arbitrage, Merger Arbitrage, Capital Structure Arbitrage, Equity Long Short, Managed Futures, Momentum, etc.

Hedge Fund of Funds Model Cost Summary

- The net internal operating costs of the funds within the Hedge Fund of Funds Model is 1.83%.*

- This is comparable to the Morningstar Category Average of Multi-Alternative Funds 1.79% (Source: Morningstar Direct)

Model Benefits When Compared to Traditional Hedge Fund of Funds

- Full liquidity on a daily basis (no minimum lockup period)

- 1099 reporting (no K-1s)

- Improved Transparency with respect to underlying holdings

*As of 9/30/2019. The Model Weighted Average Net Expense Ratio applies only to the portion of the model that is comprised of mutual funds and/or ETFs. It reflects expense waivers or reimbursements from the fund companies, which may not be permanent. The data used to calculate the Model Weighted Average Net Expense Ratio is obtained from a third-party data provider and is believed to be accurate, but has not been verified by Envestnet. The Model Weighted Average Net Expense Ratio will only be shown if fund expense ratios are available on all mutual funds and ETFs used in the model.