Private Equity Model

- Home

- Private Equity Model

The objective of this model is to hold securities that have some resemblance to the private equity market either directly or indirectly. The model is broadly diversified and has a bias to domestic securities. Since public private equity is an oxymoron, the publicly traded securities held are proxies for the private equity market.

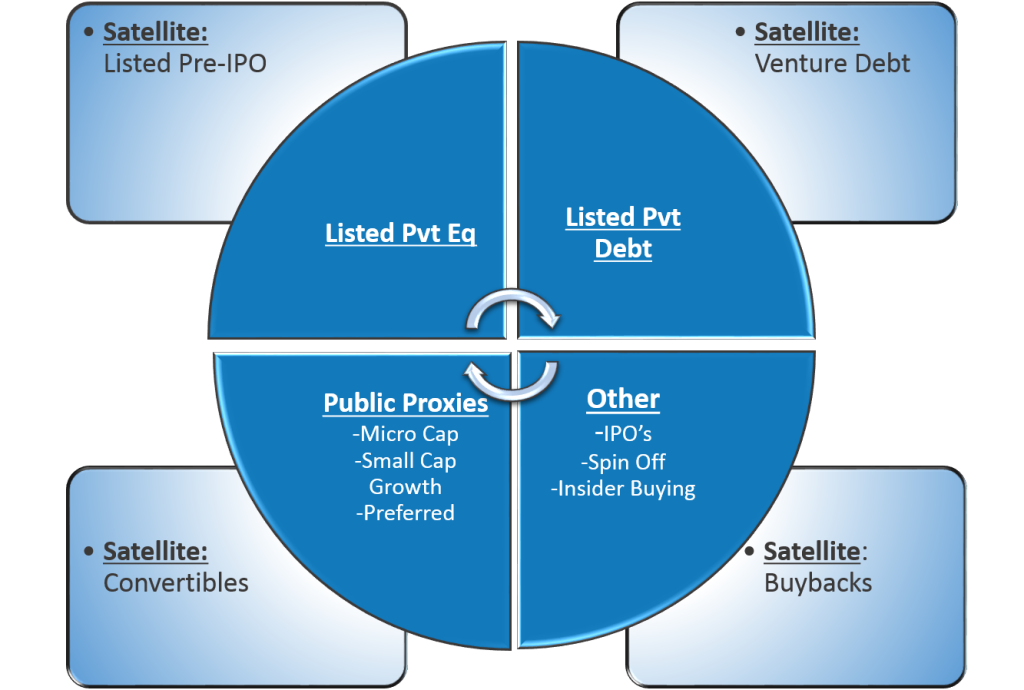

PRIVATE EQUITY MODEL CORE-SATELLITE IMPLEMENTATION

A Core and Satellite approach has been used to build this model, with the Core including low cost, primarily market capitalization weighted ETFs across four main segments of the market:

1 ) Listed private equity funds

2) Listed private debt funds

3) Publicly traded traditional proxies for private equity and

4) Publicly traded alternative proxies.

The Satellite allocations include ETFs that track alternative indices, attempting to add alpha over the Core indices. Examples include pre-IPO business development companies, venture debt, convertibles, companies doing buybacks, etc.

Private Equity Model Cost Summary

- The weighted average cost of the Private Equity Model is 0.71%*

- This compares very favorably to the Morningstar Category Average of World Stock Mutual Funds of 1.20% (Source: Morningstar Direct)

- This is a reduction of 41% when compared to active money manager costs

*As of 9/30/2019. The Model Weighted Average Net Expense Ratio applies only to the portion of the model that is comprised of mutual funds and/or ETFs. It reflects expense waivers or reimbursements from the fund companies, which may not be permanent. The data used to calculate the Model Weighted Average Net Expense Ratio is obtained from a third-party data provider and is believed to be accurate, but has not been verified by Envestnet. The Model Weighted Average Net Expense Ratio will only be shown if fund expense ratios are available on all mutual funds and ETFs used in the model.