Endowment Investment Philosophy®

- Home

- Endowment Investment Philosophy®

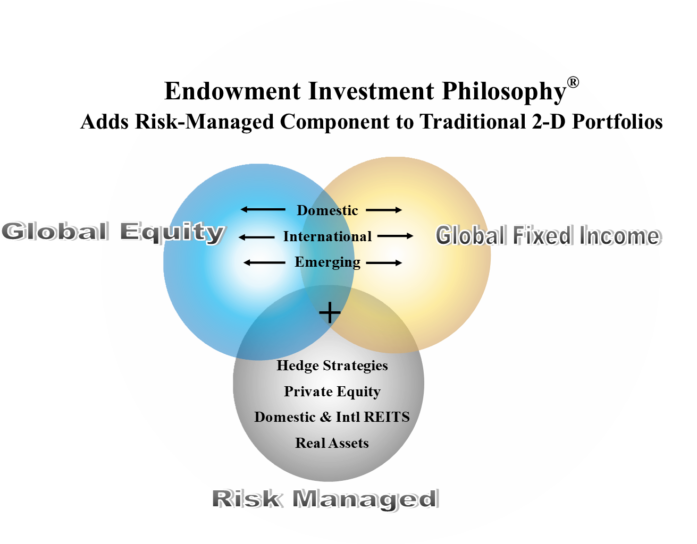

Endowment Investment Philosophy®

You Can Implement the Endowment Investment Philosophy as a:

Foundation/Endowment/ Family Office:

Please call Prateek Mehrotra, Chief Investment Officer, MBA, CFA, CAIA, at (920) 785-6010Call: (920) 785-6010 to learn about how you can reduce your management costs through our outsourced CIO services. Please sign-up below to receive the Endowment Index fact sheet and periodic updates.

401(K) Plan Sponsor/Adviser:

Please call Tim Landolt, Managing Director, MBA, at (920) 785 – 6012 to learn how you could add Endowment Target Risk Models to your 401(K) investment lineup.

Investment Adviser:

Please call Tim Landolt, Managing Director, MBA, at (920) 785 – 6012 to learn how to implement the Endowment Investment Philosophy in your client portfolios. Learn more about our 7 ETF Based Models.

Individual Client:

Visit www.MyRoboAdviser.com or call Tim Landolt, Managing Director at (920) 785 – 6010 to learn more.

Request the Endowment Investment Philosophy White Paper

For Financial Professionals.

* Please fill out required fields in their entirety

or Accredited Investors. (Please Review The Definition Here)

Net Worth: Over $1 million, excluding primary residence (individually or with spouse or partner).

Income: Over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

Professional: One of the following

- Investment professionals in good standing holding a Series 7, 65, or 82 license.

- Directors, executive officers, or general partners (GP) of the company selling the securities (or of a GP of that company).

- Any “family client” of a “family office” that qualifies as an accredited investor.

- ETF Model Solutions values your privacy and we will not sell or share your contact information with unaffiliated entities.

*Refers to underlying components. Reported index results do not have fees and expenses. You typically cannot invest directly into an index.