Global Multi-Asset Income Model

- Home

- Global Multi-Asset Income Model

The objective of this model is to generate a high combined dividend and interest income from equity, fixed income and hybrid securities, while maintaining long term capital appreciation. The model will strive to maintain a balance between equity, fixed income and hybrid securities to generate optimal risk-adjusted returns. The model targets securities that have a global footprint. The model may provide less interest rate sensitivity than traditional fixed income securities due to income being generated from multiple sources.

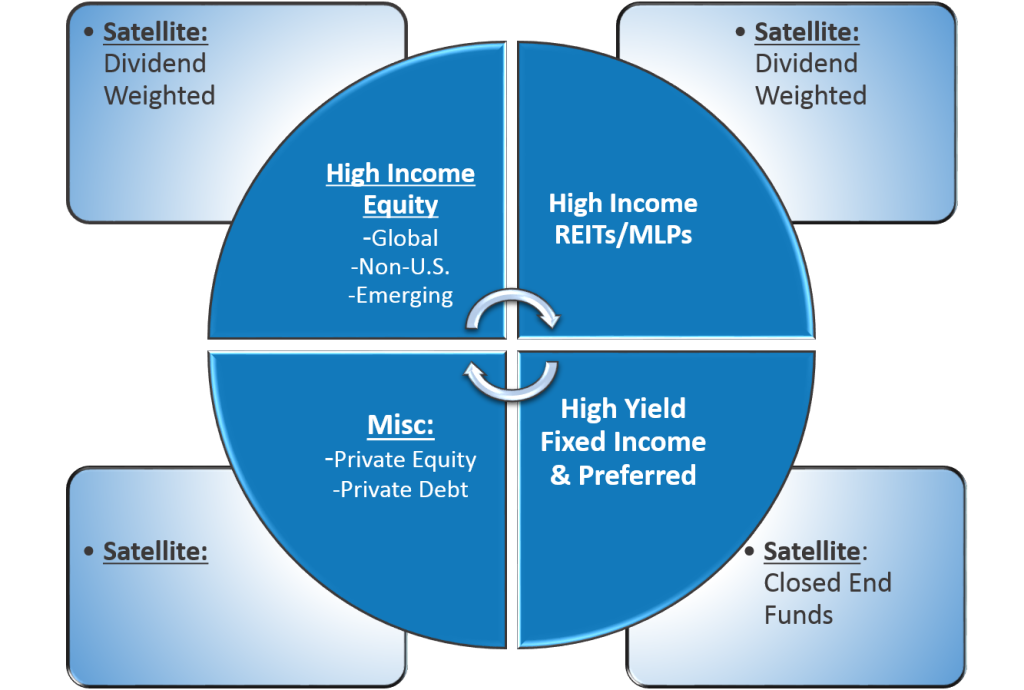

GLOBAL MULTI-ASSET INCOME CORE-SATELLITE IMPLEMENTATION

A Core and Satellite approach has been used to build this model, with the Core including low cost, primarily market capitalization weighted ETFs across four main segments of the market:

1) Global High Income Equities

2) Global Real Estate Investment Trusts/Master Limited Partnerships

3) Business Development Companies/Closed End Funds and

4) High Yield Fixed Income/Preferred Securities.

The Satellite allocations include ETFs that track alternative indices, attempting to add alpha over the Core indices. Examples include sector/thematic ETFs, mortgage REITs, MLPs, closed end funds, high yield muni’s, emerging market corporate bonds and short duration high yield bonds, etc.

Global Multi-Asset Income Model Cost Summary

- The 12-month yield on this Model as of 9/30/2019 was 7.61%

- The weighted average cost of the Global Multi-Asset Income Model is 0.99%*

- This compares very favorably to the Morningstar Category Average of 50 to 70% Equity Mutual Funds of 1.11% (Source: Morningstar Direct)

- This is a reduction of 11% when compared to active money manager costs

*As of 9/30/2019. The Model Weighted Average Net Expense Ratio applies only to the portion of the model that is comprised of mutual funds and/or ETFs. It reflects expense waivers or reimbursements from the fund companies, which may not be permanent. The data used to calculate the Model Weighted Average Net Expense Ratio is obtained from a third-party data provider and is believed to be accurate, but has not been verified by Envestnet. The Model Weighted Average Net Expense Ratio will only be shown if fund expense ratios are available on all mutual funds and ETFs used in the model.