Recently, low volatility ETFs have become increasingly popular. The PowerShares S&P 500 Low Volatility Portfolio (SPLV, $41.19 – NYSEArca) invests in the top 100 S&P 500 stocks that have been least volatile for the trailing 12 months. SPLV seeks to alleviate downside risk and the opportunity to participate in rising markets. However, low volatility ETFs like SPLV aren’t just for risk-averse investors. Over the last 25+ years, low volatility has outperformed the market, primarily due to outperformance in years with negative market returns.

The fund’s holdings have relatively stable earnings and are less sensitive to the business cycle than the average stock in the S&P 500. Historically, they tend to hold up better than their peers during market downturns and will lag during bull markets.

As an example, CVS Health (CVS, $96.26 – NYSE), is one of the largest holdings in the fund. Its earnings grew by 22% in 2008 while the earnings for all of the companies in the S&P 500 fell by 78%. CVS’ stock held up better during the market crash, when it lost 27% compared with a drop of 37% for the market.

Some critics say low volatility funds are overvalued. According to O’Shaughnessy Asset Management, the lowest-volatility decile of stocks has a P/E ratio that is 34% more expensive than its 52-year historical average. Yet, in the case of low volatility stocks, research shows that excess returns have been driven more by the macroeconomic environment than by security valuations. Valuations may even provide the wrong signal to investors. Since low volatility investors aren’t compensated for assuming risk, valuations may not play a traditional role in determining performance.

We see SPLV as a satellite holding in the domestic allocation of our global equity portfolios. It really exploits an anomaly; it’s an institutional strategy wrapped up in an ETF at a low cost. ETF Model SolutionsTM has held SPLV in our strategic equity models since 2014. Because our focus is on improving overall risk-adjusted returns for our client portfolios & models, SPLV fits into this mold by providing those characteristics.

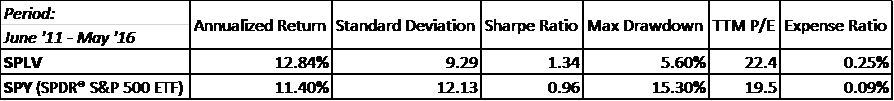

PowerShares S&P 500 Low Volatility Portfolio ETF – Key Metrics

The information presented by ETF Model SolutionsTM, LLC. is not specific to any individual’s personal circumstances and should not be taken as personal investment advice, nor should it be construed as a firm recommendation. Content is provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. If you have any questions please call our offices at 920-785-6010.