The second largest retirement pool of retirement savings in the world¹, the Government Pension Investment Fund, Japan (“GPIF”) recently announced a new policy asset mix for the medium-term plan. The policy change is based upon certain economic assumptions, including expectations that interest rates will rise in the next decade. In addition, the review period was accelerated due to expectations that Japan is positioned to “significantly transform itself from economy of persistent inflation”.

The report indicates that the Fund will develop a team dedicated to alternative investments and that alternative investment will be made with a maximum target allocation of 5% of the total portfolio. The newly added alternative investments will be classified into the portfolio’s current asset classifications of domestic bonds, domestic stocks, international bonds or international stocks, “depending on their risk and return profiles”.

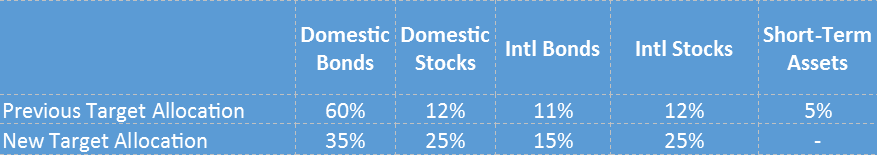

The following describes the Fund’s targeted allocations to its defined asset classes:

As of 6/30/2014, the Fund was invested as follows: Domestic Bonds (53.36%), Domestic Stocks (17.26%), International Bonds (11.06%), International Stocks (15.98%) and Short-term Assets (2.34%).

The policy change is effective immediately and the Fund will begin the transition towards its new targets.

¹source: Wikipedia